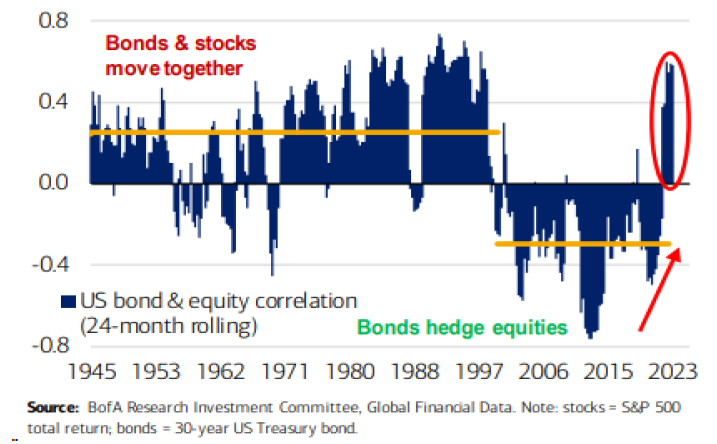

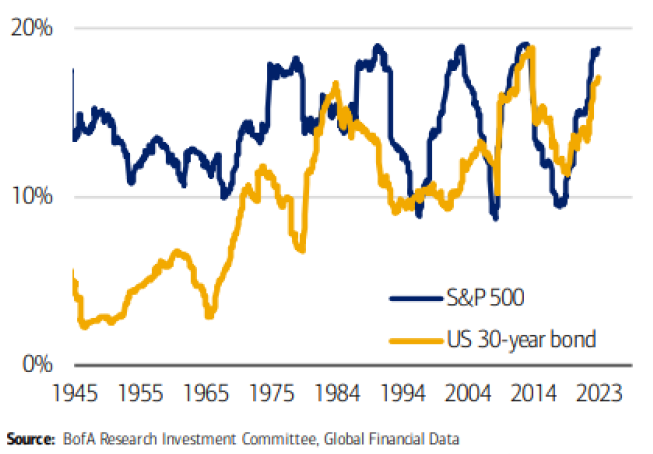

The last few months have felt reminiscent of 2022. Since the end of July through the end of October, long-term treasuries have delivered a return of approximately -15%, while the S&P 500 has returned about -8%. Downward momentum has yet to abate, as the technical picture for stocks continues to deteriorate and yields have hit 10-year highs. Bonds are now just as volatile as stocks & highly correlated. (chart 1 & 2). A static “set it and forget it” model seems increasingly more like “deer in the headlights”. This sets up tough choices in asset allocation, but we believe presents advantages for active and tactical strategies.

Rolling 24-month correlation between US stocks and treasury bonds

(Chart 1)

5-year Realized Volatility Annualized

(Chart 2)

Macroeconomic Outlook

The US economy is on a knife-edge where weaker growth could tip it into recession while stronger growth could trigger a second wave of inflation. Both outcomes will lead to a recession. But this likely will not happen until the second half of 2024. While the economy has held up past many expectations, a look at the history of recent decades shows that such long and variable lags between policy tightening triggering a recession signal and the recession’s actual arrival is typically longer than 12 months. In other words, just because a US recession has not occurred yet does not mean that one will not strike in the next 12 months.

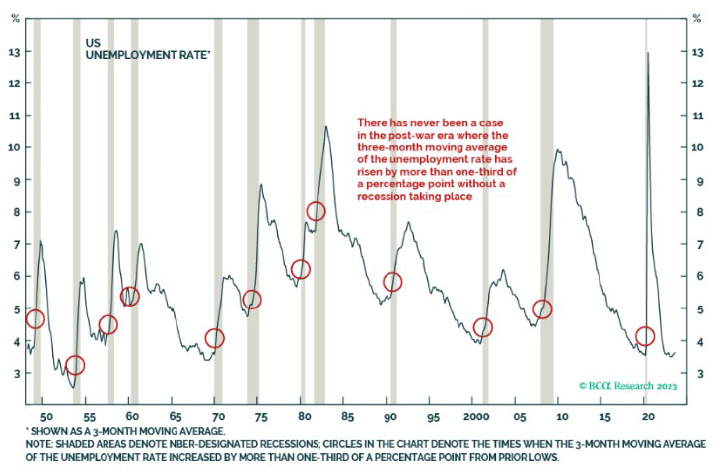

When Unemployment Starts Rising, It usually Keeps Rising

(Chart 3) Source: BCA Research

One look at the US unemployment rate reveals that it is a highly mean-reverting series. When it gets to very low levels, it typically starts rising again. And when it starts rising, it keeps rising: The US has never avoided a recession when the 3-month average of the unemployment rate has increased by more than one-third of a percentage point. The rate has already stalled, and is no longer in a downward trend. (chart 3).

Inflation Risk?

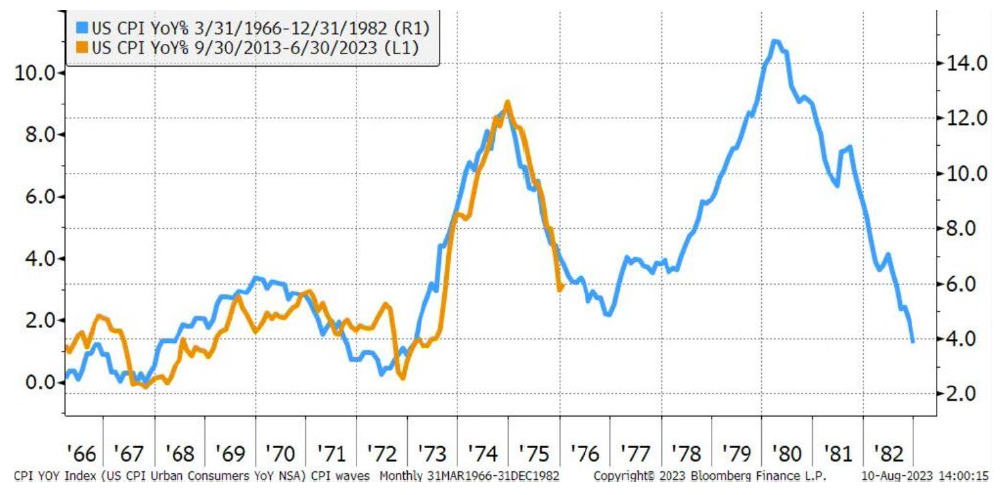

Many of the tailwinds that have pushed inflation lower this year have either receded or flipped. Higher energy prices, higher food prices, a weaker dollar, and fiscal loosening all set the stage for another bout of inflation. And falling inflation could even sow the seeds of its own demise. Consumption and real income growth are highly correlated. If inflation continues to fall, real wages will rise further. If that were to happen, the resulting increase in consumption could cause inflation to reaccelerate. As previously mentioned earlier in the year (Feb MIM), we discussed deflationary pressures for 2023 and that inflation is following a similar path to the 1970’s, where we saw a second surge of inflation. (chart 4). There are other structural forces like aging demographics, deglobalization, and stronger labor unions

providing tailwinds.

(Chart 4) Source: Bloomberg

Therefore, we believe there is uncertainty over how quickly inflation will fall, and if it does fall, whether it will stay down. This against a backdrop of equities discounting a return to a “2% world”. We believe the US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. The Federal Reserve would be forced to make a difficult choice: either to accept above-target inflation as a permanently embedded feature of the US economy, or to tighten policy enough to cause the severe recession required to bring inflation down to its 2% target.

Bonds

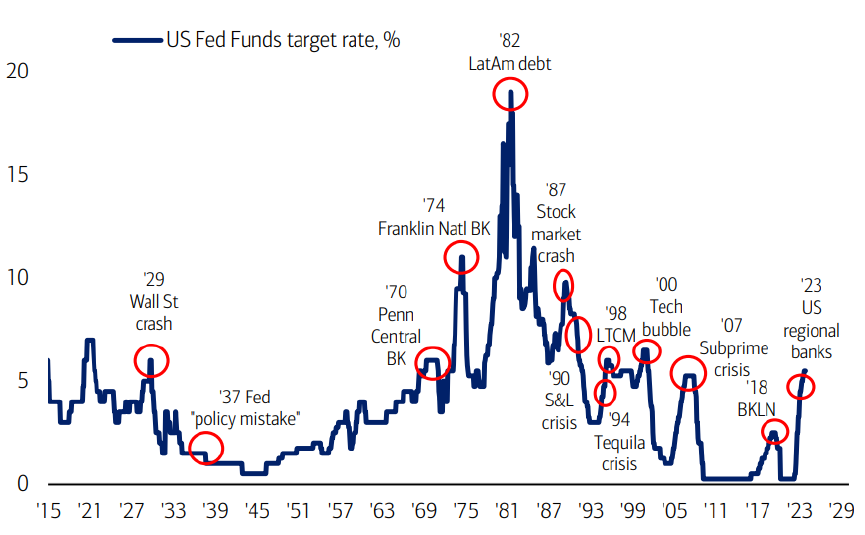

Historically, financial accidents happen when the Fed raises interest rates. (chart 5). And despite a Fed pause, yields continue to shoot higher. We tend to dislike assets that do not rally on good news and the near-term momentum on yields may likely be to the upside. But the move has also created a valuation opportunity.

(Chart 5) Source: BofA Global Investment Strategy, GFD Finaeon, Bloomberg

We have had bearish tilt towards duration the past few years. At this point, however, with the 10-year yield at 4.80%, the risk-reward to owning longduration bonds has improved. Within our funds, we have added to treasuries across the short and long-term. If it becomes clear that the US economy is sliding into recession – for example if jobless claims start to rise rapidly – we will likely lengthen duration further. Over strategic timeframes, we believe rates are going to be higher for longer, but markets do not move in straight lines and recession or slower growth will buck the current trend.

Equities

We believe stocks should rally into the end of the year but are no longer as bullish over longer timeframes because of the macroeconomic outlook. But stocks do not usually start selling off until six months before a recession. Additionally, markets are oversold on shorter timeframes and the next few months have strong seasonality, which could provide tailwinds.

Another factor that could potentially aid stocks is that sentiment and positioning are not yet stretched. According to the latest BofA Global Fund Manager Survey, institutional investors were around one standard deviation underweight stocks in early October. Speculators remain net short S&P 500 futures. Bears outnumbered bulls by double in the latest American Association of Individual Investors (AAII) survey.

Bottom Line

We do not believe this time is different, but this time is longer. A recession can be deferred (and has) but won’t be denied. A decline in bond yields from their recent highs should fuel a blow off risk rally in Q4, but risk assets could weaken in 2024.

Overall, our top-down asset allocation is close to neutral. We have added to risk in our fundamental strategies to take advantage of what we believe could be a year-end rally. Our rules-based strategies are mostly positioned for risk, but the technical picture remains clouded for both stocks and bonds. Things could change quickly.

We will continue to monitor our portfolios as the facts change and will remain tactical as the situation evolves. We believe markets are at a point of inflection and will manage assets accordingly.

Donoghue Forlines Portfolios

In today’s environment, the 60/40 retirement rule is stuck in the past. Advisors are challenged to rethink foundational portfolio elements of investor portfolios – which means seeking out strategies that bolster the “core” going forward. With no cheap assets, tactical and unconstrained management is now more important than ever.

Directing capital into the same fixed share of equities/bonds/ cash, no matter what changes in the market cycle or global economy is a big risk. The correlation between asset classes changes over time and advisors need to update accordingly.

We continue to focus on the need to help craft easy-to-understand, longer-term narratives for Advisors and their Clients. Panicking and abandoning diversified investment strategies during volatility and market crashes/surges is a time-tested losing proposition.

Donoghue Forlines solutions are designed to be client-centric and deliver strong risk-adjusted return streams through both our rules-based, tactical strategies as well as our global macro, fundamentally driven tactical solutions. We aim to capture the majority of the upside but more importantly to avoid the majority of the downside.

We have continued to carefully assess exposure across all our portfolios over the past quarter, as per our risk management process. Our positioning is outlined in more depth below. We have made moves to protect against downside in current markets.

We will stay vigilant with our goal of seeking strong risk-adjusted returns. Please visit our website at www.donoghueforlines.com for our latest information including Fact Sheets for the entire suite of products. Thank you for your confidence in Donoghue Forlines. Please let us know if you have any questions.

Best regards,

Best regards,

Jeffrey R. Thompson

Chief Executive Officer

Portfolio Manager

The following reflects Donoghue Forlines’ portfolios positioning as of September 30, 2023.

Donoghue Forlines Dividend Portfolio

Positioning: 100% allocated to large and mid-sized high yielding stocks with a diversified sector exposure and quality orientation.

During the quarter, there was one tactical overlay signal. On July 12th, the portfolio had a buy signal, and moved its exposure to 100% large and mid-sized high yielding stocks with a diversified sector exposure and quality orientation. On September 7th, the portfolio was reconstituted and rebalanced.

Donoghue Forlines Momentum Portfolio

Positioning: 100% allocated to large and mid-sized stocks exhibiting strong short-term momentum with diversified sector exposure and quality orientation.

During the quarter, there were no technical overlay signals. On September 7th, the portfolio was reconstituted and rebalanced.

Donoghue Forlines Treasury Portfolio

Positioning: 100% invested in intermediate-term U.S. Treasury bonds via ETF exposure.

During the quarter, the portfolio received several technical triggers amid fixed income volatility. On August 21st, the portfolio moved from intermediate duration to long durations bonds. On August 30th, the portfolio received a trigger to move the portfolio back to intermediate duration. On September 26th, the portfolio received another trigger to move the portfolio to long duration bonds.

BLENDED SOLUTIONS

The blended solutions combine the best ideas from our rules-based and global macro solutions into long-term investment solutions.

Donoghue Forlines Income Portfolio

The DF Income Portfolio’s asset allocation at the quarter end is as follows: 16% in cash, 74% in fixed income, 5% in equities, and 5% in alternatives.

Target Allocations: Donoghue Forlines Tactical Income Fund (55%); Donoghue Forlines Risk Managed Allocation Fund (24%); Donoghue Forlines Tactical High Yield ETF (15%); Donoghue Forlines Dividend Fund (4%) and 2% Cash.

Donoghue Forlines Dividend & Yield Portfolio

The DF Dividend and Yield Portfolio’s allocations at quarter end are as follows: 14% in cash, 49% in fixed income, 26% in equities, 11% in alternatives.

Target Allocations: Donoghue Forlines Tactical Income Fund (40%); Donoghue Forlines Tactical Allocation Fund (27%); Donoghue Forlines Risk Managed Income Fund (15%); Donoghue Forlines Dividend Fund (12%); Donoghue Forlines Momentum Fund (4%); and 2% Cash.

Donoghue Forlines Growth & Income Portfolio

The DF Growth and Income Portfolio’s allocations at quarter end are as follows: 10% in cash, 31% in fixed income, 49% in equities, and 10% in alternatives.

Target Allocations: Donoghue Forlines Tactical Allocation Fund (30%); Donoghue Forlines Momentum Fund (24%); Donoghue Forlines Tactical Income Fund (24%); Donoghue Forlines Dividend Fund (15%); Donoghue Forlines Risk Managed Income Fund (5%); and 2% Cash.

IMPORTANT RISK INFORMATION

The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate.

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financialmarket trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations to purchase or sell such securities. Forecasts are inherently limited and should not be relied upon as an indicator of future results. There is no guarantee that these investment strategies will work under all market conditions, and each advisor should evaluate their ability to invest client funds for the long-term, especially during periods of downturn in the market. Some products/services may not be offered at certain broker/dealer firms.

The investment descriptions and other information contained in this Market Commentary are based on data calculated by Donoghue Forlines LLC (Donoghue Forlines) and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. This report should be read in conjunction with Donoghue Forlines’ Form ADV Part 2A and Client Service Agreement, all of which should be requested and carefully reviewed prior to investing.

There can be no assurance that the purchase of the securities in this portfolio will be profitable, either individually or in the aggregate, or that such purchases will be more profitable than alternative investments. Investment in any Portfolio, or any other investment or investment strategy involves risk, including the loss of principal; and there is no guarantee that investment in Donoghue Forlines’ Portfolios or any other investment strategy will be profitable for a client’s or prospective client’s portfolio. Investments in Donoghue Forlines’ Portfolios, or any other investment or investment strategy, are not deposits of a bank, savings, and loan or credit union; are not issued by, guaranteed by, or obligations of a bank, savings, and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency. The composite strategy provides diversified exposure to various asset classes such as equities, fixed income, and alternatives utilizing liquid exchange-traded products. Diversification does not guarantee a profit or protect against a loss.

Investors cannot invest directly in an index. Indexes are unmanaged. Index returns assume the reinvestment of distributions, but do not reflect the deduction of a management fee, transaction and custodial charges, or other expenses; the incurrence of which would reduce the indicated historical performance results. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and therefore there are no assurances that any portfolio will match or outperform any particular benchmark.

© 2023 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Morningstar Rating is for the I share class only; other classes may have different performance characteristics.

Donoghue Forlines LLC is a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training.