First off … thank you! Another year is in the books and we are grateful to all our Advisors, Fiduciaries, Brokers, and Partners who trust us with your business. We love being able to do this every day and look forward to the future.

With the future in mind, we are debuting a new quarterly Markets in Motion that incorporates all of our SMA product offereings (fundamental, rules-based, & blended strategies). This brings our entire investment ecosystem under one production and provides easier access to information for our clients. We will continue to publish monthly Markets in Motion pieces to discuss market conditions as they evolve and will provide trade updates for all strategies. We are committed to providing risk managed and transparent solutions to all our clients.

2023: What a Difference a Year Makes

2022 was a rough year for traditional asset classes, leading to substantial losses to balanced portfolios. 2023 saw a reversal of fortune, with major stock indices rallying near records and bond yields dropping sharply from their highs. In sum, stocks and bonds bounced back.

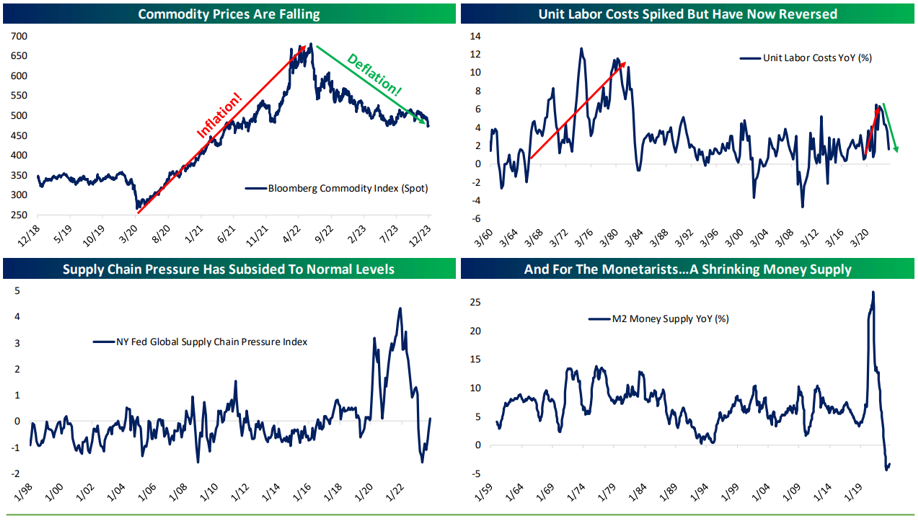

Inflation came off the boil and slowed in dramatic fashion. There are a number of indicators that reflect the disinflationary environment: commodity prices continue to fall, wage costs relative to output are back to normal, supply chains are operating as they did prior to the COVID shock, and even the money supply is declining. (Chart 1).

(Chart 1) Source: Bloomberg

While inflation numbers came down all year, the Fed remained front and center throughout 2023. They continued their historic tightening campaign with a series of hikes during the first half of the year. After what was likely the last hike in July, the Fed Funds Rate rose from zero in March 2022 up to 5.25-5.50%.

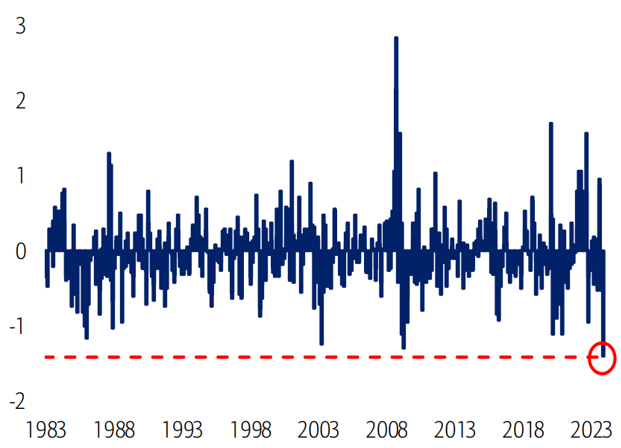

Nonetheless, the Fed did eventually pivot, which propelled a rally in disinflationary assets, particularly long-dated treasury bonds and growth-oriented equities. With hopes of a return to a 2% inflation world, the easing in financial conditions over the final two months of the year was the fastest in history. (Chart 2).

GS US Financial Conditions Index, 2 month change

(Chart 2) Source: BofA Global research, Bloomberg

This environment unleashed excitement around AI (Artificial Intelligence) and the possible productivity gains set to be unleashed by the technology. This stretched valuations of a handful of mega-cap growth companies, which powered the rally in major indices. Nonetheless, breadth was solid, and stocks remain in long-term uptrends.

2024: Risks Skewed to Downside Volatility

While all that happened in 2023 seems positive, below the surface there are cracks in the economy. We were bullish on risk assets going into 2023 but are more bearish for 2024. While stocks and other risky assets could grind higher for the next few months, our longer-term outlook dictates a more defensive posture.

The US economy is on a knife-edge where weaker growth could push it into recession while stronger growth could trigger a second wave of inflation. Both outcomes will ultimately lead to a recession. While the economy has held up past many expectations, a look at the history shows that such long and variable lags between policy tightening triggering a recession signal and the recession’s actual arrival is typically longer than 12 months. In other words, just because a US recession has not yet materialized does not mean that one will not strike in the next 12 months. This is against a backdrop of asset markets that have priced in a soft economic landing.

While the path of least resistance in the short term is higher, we suspect that this year any large moves in markets may be self-limiting. Big drops in stocks could prompt Fed cuts; big rallies further ease financial conditions and rekindle the very inflation that the Fed thought it had smothered. It is a recipe for a range-bound and volatile year, with asymmetric downside risk.

We believe bonds, with a large income cushion, could play a crucial role in portfolios in 2024. With inflation likely to keep falling in the near-term and a recession looming on the horizon, the risk-reward is tilted towards a further decline in bond yields. Longer-term, we believe rates will be structurally higher, creating tougher asset allocation decisions.

Long Term: A new Investing Paradigm

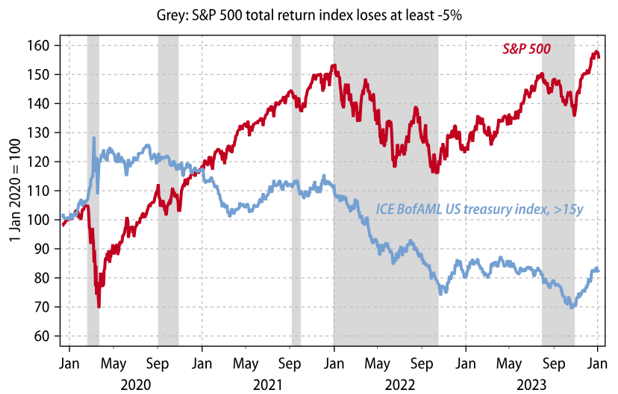

In the chart below, the shaded areas show periods in which the S&P 500 total return index lost at least -5%. In the past, such pullbacks would have likely been met with a rally in long-dated US treasuries, but this is no longer the case. Instead, US bond and equity performance during such episodes in the last three years displayed an almost 1:1 correlation. (Chart 3).

Do US treasuries still hedge the risk of equity corrections?

(Chart 3) Source: ICE BofAML, Gavekal Research/Macrobond

If it is indeed a new normal, then the long-term implications for portfolio management are dramatic. After all, most pension funds, insurance companies and private portfolios are built on the premise that exposure to bonds reduces portfolio volatility and limits downside risks. While short-term we could see treasuries act as a safe haven during the next recessionary cycle, longer term investors will need to adapt portfolios to achieve diversification and client goals. “Buy and Hold forever” is no longer a reasonable strategy for many fixed income asset classes.

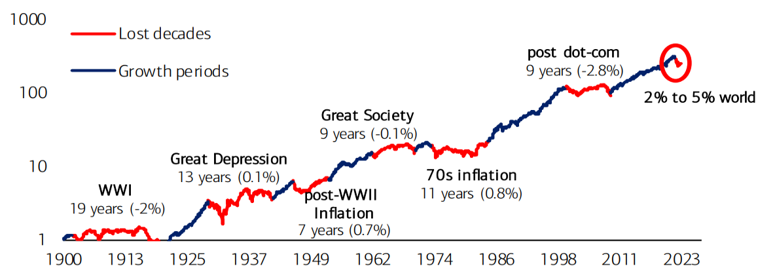

We believe the importance of tactical asset allocation will be critical to clients meeting their long-term objectives. A 60% equity and 40% bond portfolio, the guidepost of moderate strategic asset allocation, has experienced multiple “lost decades” over history. (Chart 4).

Cumulative performance of a 60/40 portfolio, real prices, log scale

(Chart 4) Source: BofA Research Investment Committee, Global Financial Data. Note: 60/40 = 60% S&P 500 total return and 40% US 10-year bond total return.

Therefore, we continue to stress the importance of tactical management. In today’s low-return environment, advisors are challenged to rethink foundational elements of investor portfolios – which means seeking out strategies that bolster the “core” going forward. We will continue to provide solutions for the next generation of investing.

Fundamental Portfolios

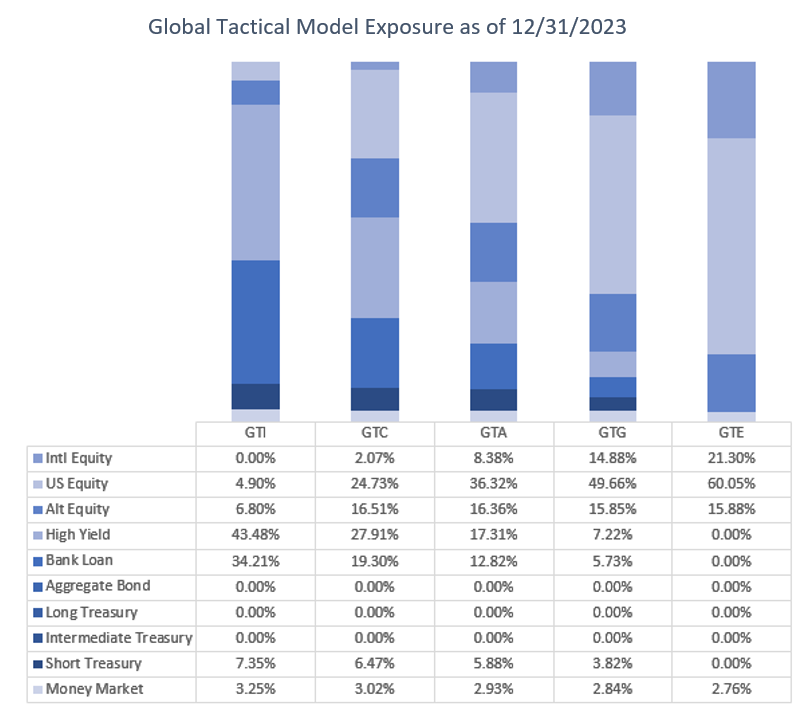

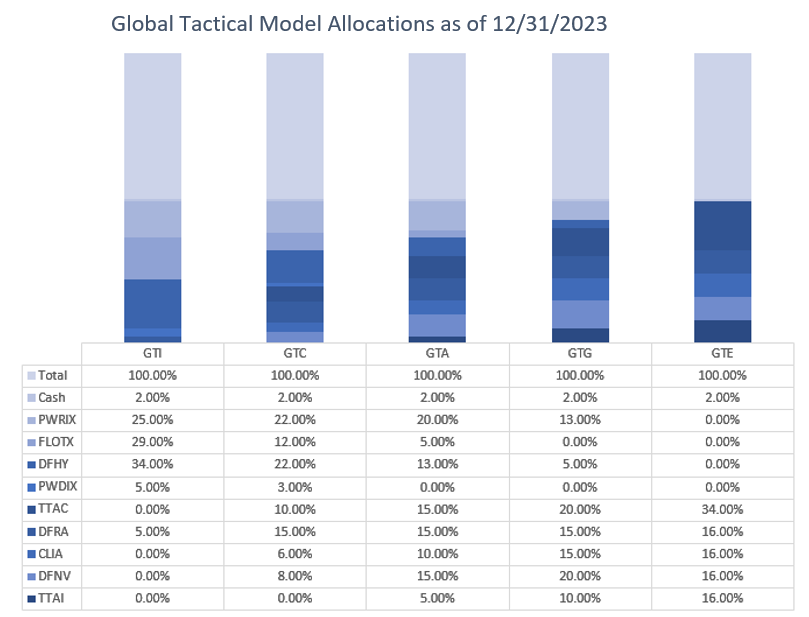

Our global tactical portfolios had a successful run in 2023. We were able to capture upside in risk markets, taking advantage of opportunities in equities and credit.

As we enter 2024, our portfolios are positioned neutral to risk. At the end of December, we removed overweight positions in equity, and we are preparing to move positioning even more defensively as the year evolves. This will include larger allocations to tactical fixed income investments across the term premium.

We will adapt as the facts change and focus on catalysts for investment regime change.

(Positioning as of 12/31/2023)

Rules Based Portfolios

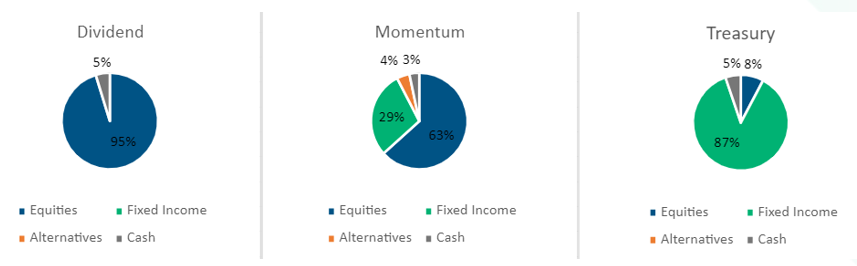

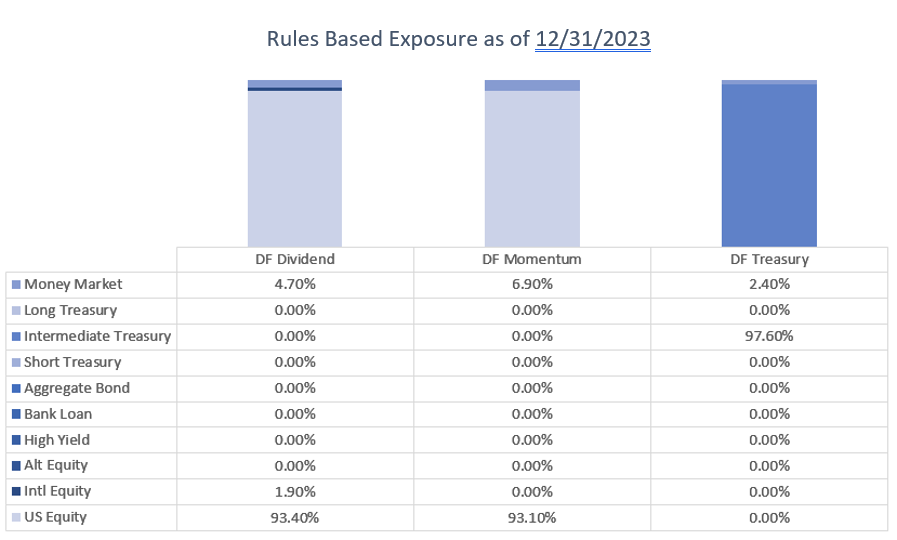

Our Momentum strategy remained fully invested in equities throughout the year and was able to take advantage of the risk-on environment. The technical picture for growth stocks remains in an uptrend and would likely need to see quick price deterioration to trigger a more defensive posture.

Our Dividend strategy received two defensive signals throughout the year to move 50% of the portfolio into short-term treasuries. The first was in March during the regional banking crisis and the second was in October after a sell-off as bonds peaked. In both cases, the downside was a head fake and we bought back into equities at higher prices in the following months. The technical picture for value equities remains in an uptrend but is weaker than stocks broadly. If markets were to turn, we could see the Dividend strategy move to a defensive posture more quickly. We believe dividend stocks are poised to outperform broader equities in 2024.

Our Treasury strategy remained in shorter duration instruments for the majority of the year but did take advantage of the long end of the curve in the 3rd quarter. Despite a drop in yields over the last two months, the portfolio is still invested in intermediate-term treasuries as the health of credit markets is still robust. We expect to allocate to longer duration bonds more frequently in 2024.

(Positioning as of 12/31/2023)

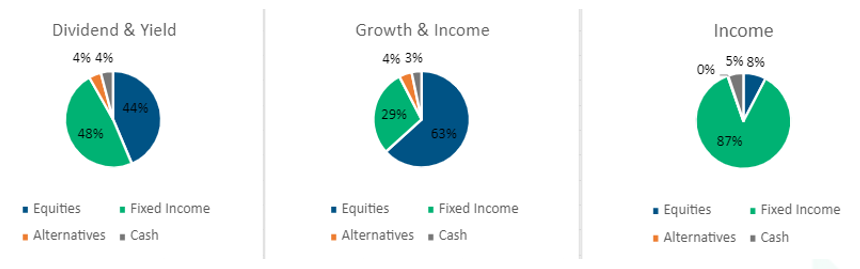

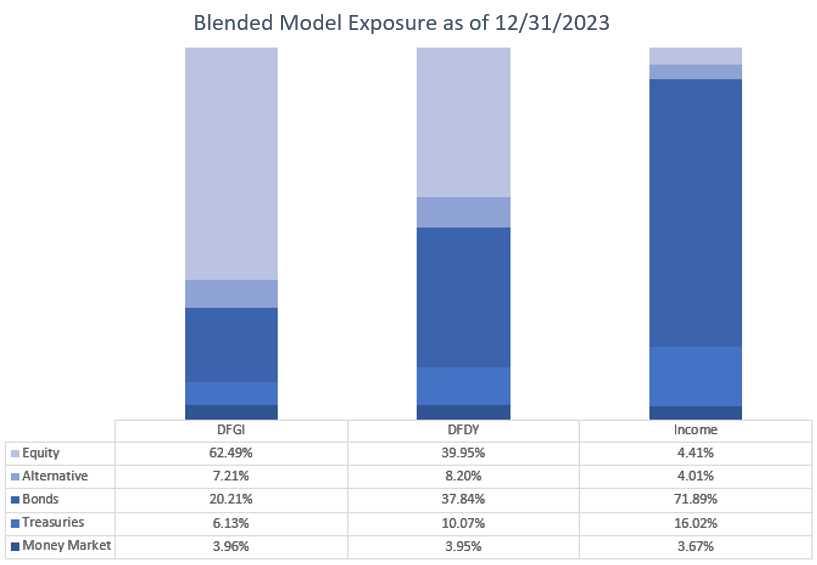

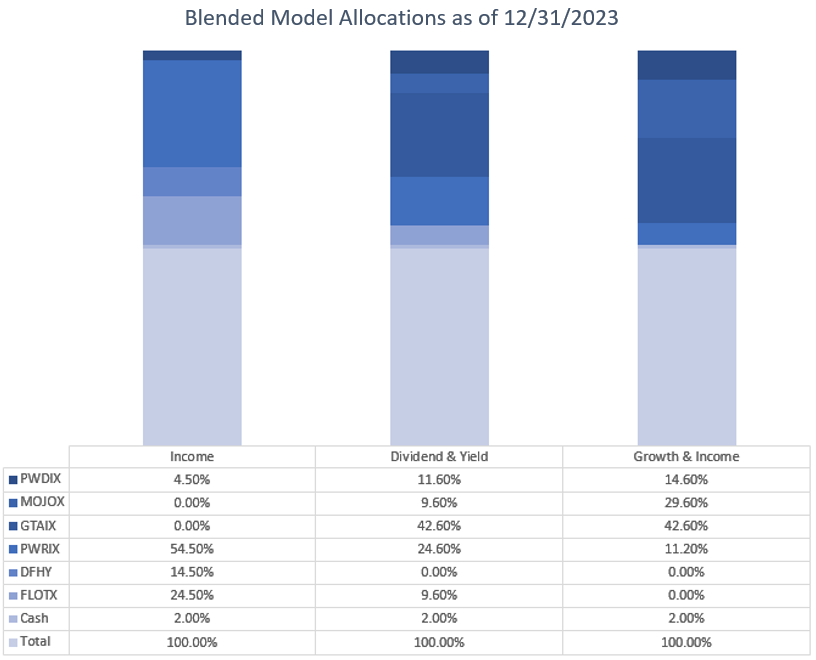

Blended Portfolios

The blended portfolios are a proprietary mix of our fundamental macro portfolios and our rules-based quantitative portfolios.

Through this combination, we were able to take advantage of the sanguine risk environment in 2023. Our top-down asset allocation mirrored our fundamental outlook and overweighted our tactical allocation and tactical income funds in the strategies, where we were primarily invested in equities & credit. We increased allocations to our fundamental macro funds throughout the year to give the portfolios more flexibility to move defensively when the time comes. Our momentum fund remained invested for the entirety of the year, while our dividend fund experienced two defensive triggers to move 50% of the portfolio into short-term treasuries. Our risk managed fund was positioned in money markets for the beginning of the year, and tactically allocated to high yield and floating rate securities throughout the year.

Heading into 2024 our top-down asset allocation mirrors our fundamental outlook – positioned neutral to risk — our equity rules-based strategies are currently fully invested, and our risk managed income fund is positioned in high yield and floating rate securities. We recently increased allocations to our multi-asset funds to give the portfolios more flexibility to move defensively when the time comes. We will adapt as the facts change and focus on catalysts for investment regime change.

(Positioning as of 12/31/2023)

Best regards,

Best regards,

John A. Forlines III

Chief Investment Officer

IMPORTANT RISK INFORMATION

Past performance is no guarantee of future results. Performance prior to January 1, 2018 was earned on accounts managed at a predecessor firm, JAForlines Global. The person primarily responsible for achieving that performance continues to manage accounts at Donoghue Forlines in a substantially similar manner. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. The investment descriptions and other information contained in this Markets in Motion are based on data calculated by Donoghue Forlines LLC and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate. The calculation and presentation of performance has not been approved or reviewed by the SEC or its staff.

The Donoghue Forlines Global Tactical Allocation Portfolio composite was created July 1, 2009. The Donoghue Forlines Global Tactical Income Portfolio composite was created August 1, 2014. The Donoghue Forlines Global Tactical Growth Portfolio composite was created April 1, 2016. The Donoghue Forlines Global Tactical Conservative Portfolio composite was created January 1, 2018. The Donoghue Forlines Global Tactical Equity Portfolio composite was created January 1, 2018. The Donoghue Forlines Dividend Portfolio Composite was created on January 1, 2013. The Donoghue Forlines Treasury Portfolio was created on August 1, 2017. The Donoghue Forlines Momentum Portfolio Composite was created March 1, 2016. The Donoghue Forlines Dividend & Yield Portfolio Composite was created December 1, 2011. The Donoghue Forlines Growth & Income Portfolio Composite was created January 1, 2015. The Donoghue Forlines Income Portfolio Composite was created June 1, 2008.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Individual portfolio returns are calculated monthly in U.S. dollars. These returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results. Performance reflects the re-investment of dividends and other earnings.

Net 3% Returns

For all portfolios, net 3% returns are presented net of a hypothetical maximum fee of three percent (3%). Actual fees applicable to an individual investor’s account will wary and no individual investor may incur a fee as high as 3%. Please consult your financial advisor for fees applicable to your account. Individual returns will vary.

Fee Schedule

The investment management fee schedule for all portfolios is: Client Assets = All Assets; Annual Fee % = 0.00%. Actual investment advisory fees incurred may vary and should be confirmed with your financial advisor.

Each portfolio includes holdings on which Donoghue Forlines may receive management fees as the advisor and/or subadvisor or from separate revenue sharing agreements. Please see the prospectuses for additional disclosures.

The investment management fee schedule for the composites is: Client Assets = All Assets; Annual Fee % = 0.00%. Actual investment advisory fees incurred may vary and should be confirmed with your financial advisor.

The Donoghue Forlines Global Tactical Allocation Benchmark is the HFRU Hedge Fund Composite. The Blended Benchmark Conservative is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% Bloomberg Global Aggregate, rebalanced monthly. The Blended Benchmark Growth is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% MSCI ACWI, rebalanced monthly. The Blended Benchmark Income is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% Bloomberg Global Aggregate, rebalanced monthly. The Blended Benchmark Equity is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% MSCI ACWI.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage. The underlying constituents are equally weighted. The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The DJ Moderately Conservative index measures the performance of returns on its total portfolios with a target risk level of Moderately Conservative-investor will take 40% of all stock portfolio risk. Its portfolios include three major asset classes: stocks, bonds and cash. The weightings are rebalanced monthly to maintain the target level. The index is subset of the global series of Dow Jones Relative Risk Indices. The DJ Conservative index measures the performance of returns on its total portfolios with a target risk level of Conservative-investor will take 20% of all stock portfolio risk. Its portfolios include three major asset classes: stocks, bonds and cash. The weightings are rebalanced monthly to maintain the target level. The index is subset of the global series of Dow Jones Relative Risk Indices. The DJ Moderate index measures the performance of returns on its total portfolios with a target risk level of Moderate investor will to take 60% of all stock portfolio risk. Its portfolios include three major asset classes: stocks, bonds and cash. The weightings are rebalanced monthly to maintain the target level. The index is subset of the global series of Dow Jones Relative Risk Indices. The Russell 1000 Value Index is for comparison purposes only. The index is a market-capitalization weighted index of those firms in the Russell 1000 with lower price-to- book ratios and lower forecasted growth values. The Russell 1000 includes the largest 1000 firms in the Russell 3000, which represents approximately 98% of the investable U.S. equity market. The Russell 1000 Index is for comparison purposes only. The index consists of the 1000 largest companies within the Russell 3000 index. Also known as the Market-Oriented Index, because it represents the group of stocks from which most active money managers choose. The returns for the index are total returns, which include reinvestment of dividends. Frank Russell Company reports its indices as one-month total returns. The Bloomberg US Long Treasury Index, Bloomberg US Intermediate Treasury Index, are for comparison purposes only. Bloomberg US Long Term Treasury Index measures the performance of US treasury bonds with long term maturity. The credit level for this index is investment grade. Bloomberg US Intermediate Term Treasury Index measures the performance of US treasury notes with intermediate term maturity. The credit level for this index is investment grade.

Index performance results are unmanaged, do not reflect the deduction of transaction and custodial charges or a management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. You cannot invest directly in an Index. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. For a compliant presentation and/or the firm’s list of composite descriptions, please contact 800‐642‐4276 or info@donoghueforlines.com.

Donoghue Forlines LLC is a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training.