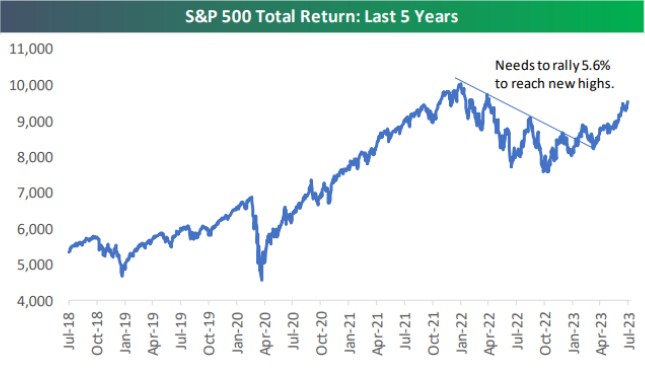

As we enter the second half of 2023, the S&P Total Return Index is up 16.9% and is now just 5.6% from making a new all-time high. Looking at the chart to the right (Chart1), ever since the top of the bear market downtrend channel was broken and then tested back in January, it has been off to the races for bulls.

But as we look towards the second half of the year, is the market glass half full or half empty?

SVB’s balance grew 250% between early 2019 and the end of 2022

(Chart 1) Source: Bespoke Investment Group

Global stocks and other risk assets have brushed off regional bank failures, the arrest of a former president (and favorite for challenging candidate in 2024), fears of a US recession, the gating of large real estate funds, disappointment in China’s reopening, and further interest rate increases from the US Federal Reserve, the European Central Bank and other major developed world central banks. In short, stocks have done an impressive job of climbing the proverbial “wall of worry.”

There are a number of factors that can explain this rally. Better-than-expected economic conditions in the first half of 2023 have contributed to this dynamic. Another obvious one is hopes of large productivity gain from artificial intelligence. And finally, tamer inflation numbers, thanks in part to stable energy prices (Chart 2).

(Chart 2) Source: Gavekal Research/Macrobond

Investor’s confidence in a “soft landing” has powered gains across risk assets, leading to a historic first half of the year. But are they right? And more importantly, going forward will the rally continue?

It would be very on brand for stocks to melt up into recession, right before a hard landing. Just as investors start piling into stocks because of the “fear of missing out” on returns. While we believe a recession has likely been delayed, we do not think a harder landing is properly priced into asset markets. The economy is still digesting the effects of lagging monetary policy, and the Fed is likely not done raising rates. The Fed still highlights risks that the market has written off as ambivalent.

While there is scope for economic data to remain resilient over the near-term and continue to support equities over a tactical investment horizon, we doubt that this resilience can be sustained over the longer term. Instead, the elevated likelihood of a recession over a 12-month horizon will eventually weigh on the performance of equities. Moreover, recovering stock prices suggest that equities are not priced for recession, making them more vulnerable to the downside in the event of an economic downturn.

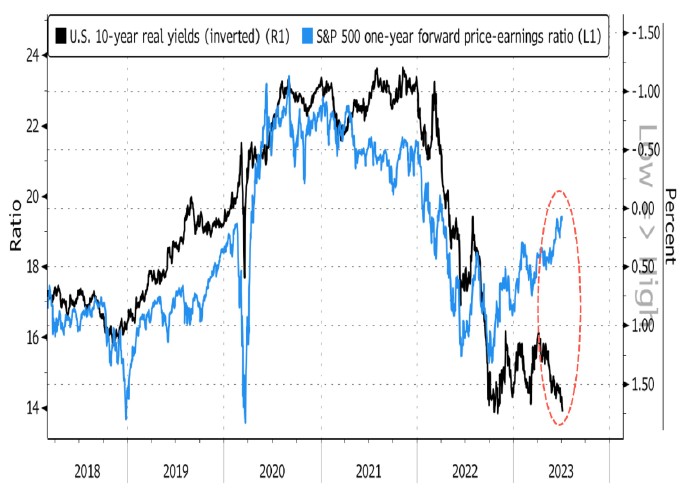

The Bond market is much more reflective of this dynamic. After moving in tandem with stocks for the past several years, they have meaningfully diverged in 2023 (Chart 3). Additionally, the yield curve remains inverted and bond volatility significantly higher than equity.

(Chart 3) Source: Bloomberg

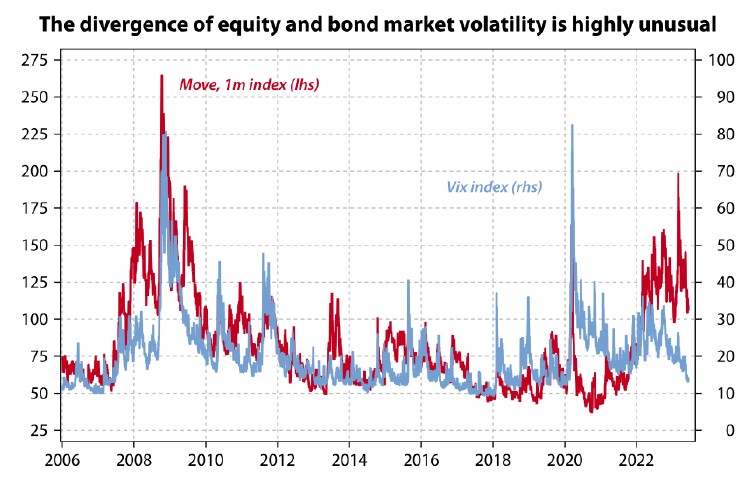

Whatever the reason, the divergence of bond and equity volatility still raises the fear that equity market volatility will play catch-up with the signal being sent by the bond market (Chart 4).

(Chart 4) Source: Gavekal

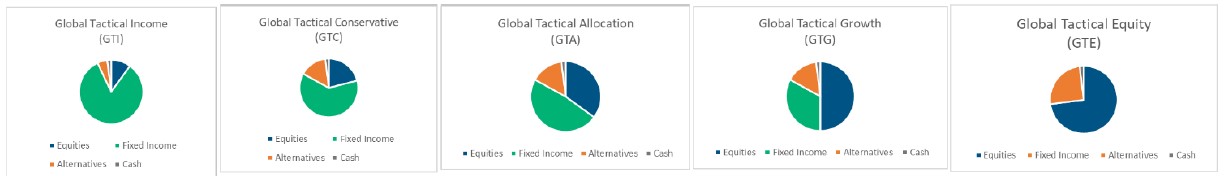

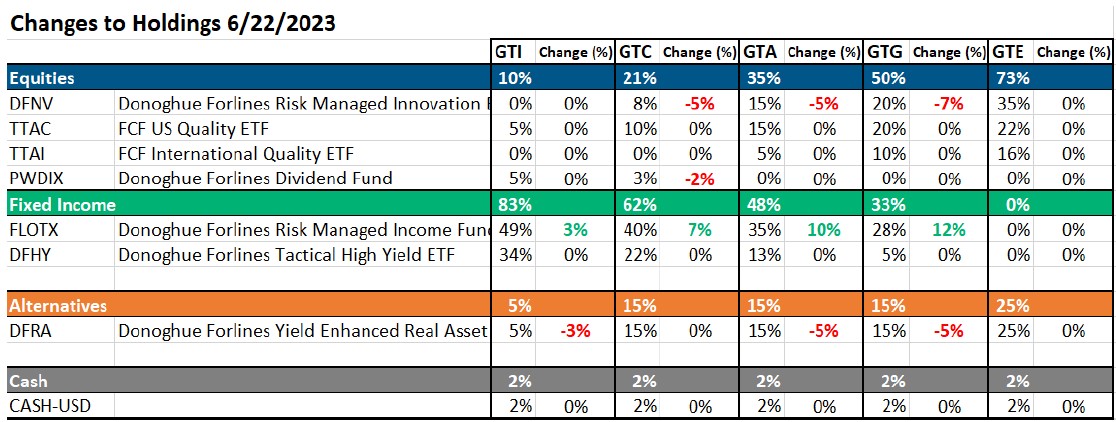

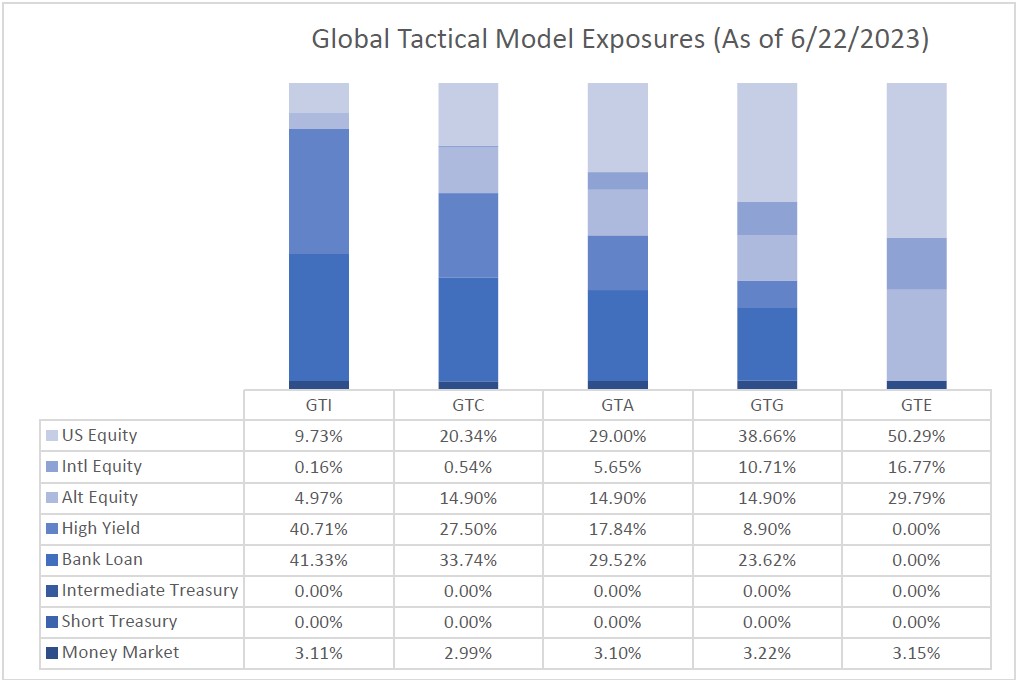

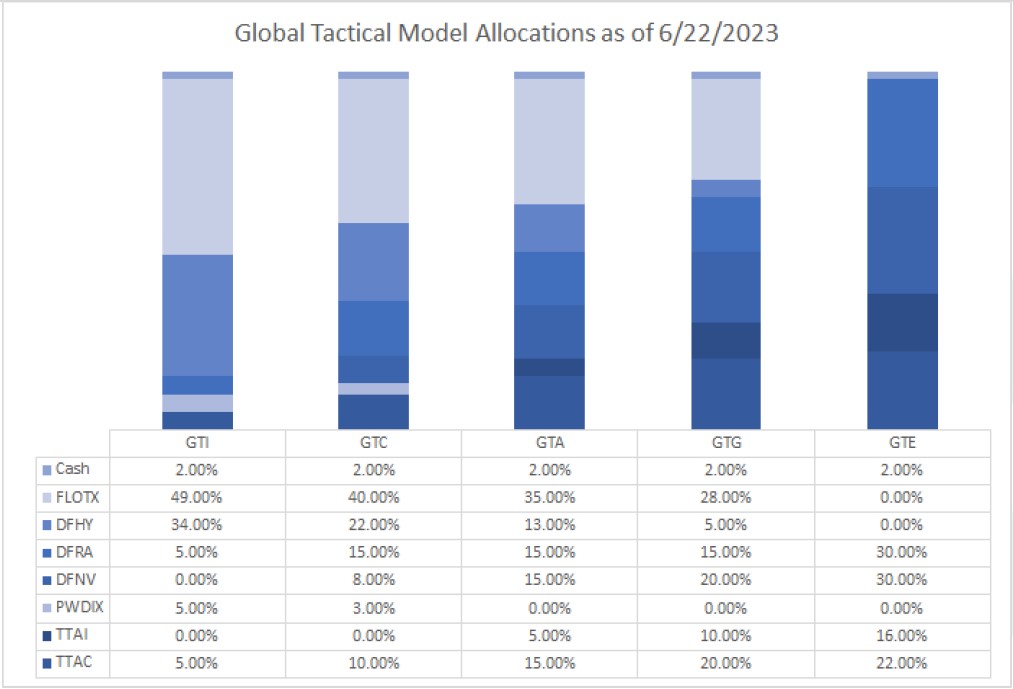

Therefore, after remaining neutral in our broader asset allocation in 2023, we have reduced equity exposure to be prudent to underrealized risks. We have increased allocations to our fixed income positions, which we feel provide better risk/reward dynamics. Ultimately, we believe risk management is the most important factor to wealth accumulation and preservation. We build portfolios with the objective of minimizing downside capture. After an incredible rally to start the year, we believe it’s prudent to begin to underweight risk assets in our portfolios. We will continue to monitor our portfolios as the facts change and will remain tactical as the situation evolves.

Recent Portfolio Changes

You can get more information by calling (800) 642-4276 or by emailing AdvisorRelations@donoghueforlines.com.

John A. Forlines III

Chief Investment Officer

Past performance is no guarantee of future results. Performance prior to January 1, 2018 was earned on accounts managed at a predecessor firm, JAForlines Global. The person primarily responsible for achieving that performance continues to manage accounts at Donoghue Forlines in a substantially similar manner. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. The investment descriptions and other information contained in this Markets in Motion are based on data calculated by Donoghue Forlines LLC and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate. The calculation and presentation of performance has not been approved or reviewed by the SEC or its staff.

The Donoghue Forlines Global Tactical Allocation Portfolio composite was created July 1, 2009. The Donoghue Forlines Global Tactical Income Portfolio composite was created August 1, 2014. The Donoghue Forlines Global Tactical Growth Portfolio composite was created April 1, 2016. The Donoghue Forlines Global Tactical Conservative Portfolio composite was created January 1, 2018. The Donoghue Forlines Global Tactical Equity Portfolio composite was created January 1, 2018.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Individual portfolio returns are calculated monthly in U.S. dollars. These returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results. Performance reflects the re-investment of dividends and other earnings.

Regarding GTA, net returns are presented net of actual management fees and include the reinvestment of all income. Actual investment advisory fees incurred by clients may vary.

Beginning January 1, 2022, the 1% model fee was no longer assessed within the performance calculation as Donoghue Forlines no longer charges a model management fee on the portfolios listed below. The portfolios includes holdings on which Donoghue Forlines may receive management fees as the adviser and/or subadvisor or from separate revenue sharing agreements. Please see the prospectuses for additional disclosure.

Regarding GTI, GTC, GTG, and GTE, the investment management fee schedule for the composites is: Client Assets = All Assets; Annual Fee % = 0.00%. Actual investment advisory fees incurred may vary and should be confirmed with your financial advisor.

The Donoghue Forlines Global Tactical Allocation Benchmark is the HFRU Hedge Fund Composite. The Blended Benchmark Conservative is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% Bloomberg Barclays Global Aggregate, rebalanced monthly. The Blended Benchmark Growth is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% MSCI ACWI, rebalanced monthly. The Blended Benchmark Income is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% Bloomberg Barclays Global Aggregate, rebalanced monthly. The Blended Benchmark Equity is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% MSCI ACWI.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage. The underlying constituents are equally weighted. The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Index performance results are unmanaged, do not reflect the deduction of transaction and custodial charges or a management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. You cannot invest directly in an Index. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. For a compliant presentation and/or the firm’s list of composite descriptions, please contact 800-642-4276 or info@donoghueforlines.com.

Donoghue Forlines LLC is a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training.