After a strong rally since the beginning of summer, stocks began to retreat after the S&P 500 rejected its 200-day moving average last week. The focus has returned to the macro backdrop, with a series of weak activity readings across the global economy. US housing data remains extremely weak with mortgage rates moving up again, mortgage applications falling, and other metrics continuing to miss. To add to that, July inflation came in lower than expected and decelerated.

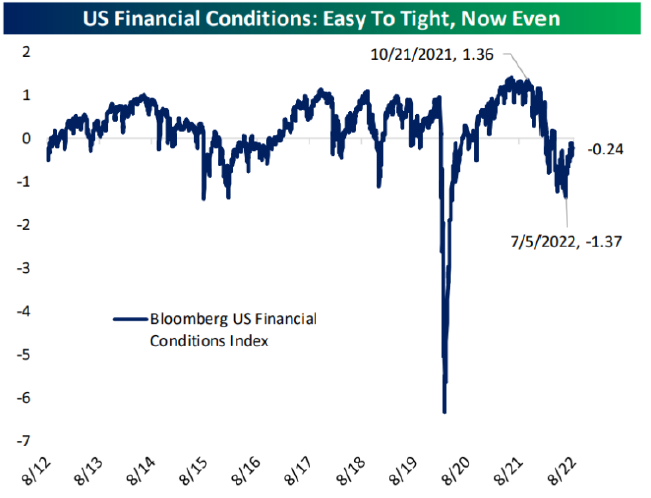

All of this data suggests the Federal Reserve might begin to pivot from their current path of aggressive monetary tightening. We believe this is primarily the reason markets rallied close to 20% off the June lows. But Jay Powell confirmed at the Jackson Hole symposium that US monetary policy is wholly focused on bringing inflation and inflation expectations back down to the Fed’s 2% target. After Powell declared “our responsibility to deliver price stability is unconditional,” risk assets sold off as investors concluded any hopes of a near-term Fed pivot to an easier stance were misplaced. The Fed did not blink. Higher stock prices, tighter credit spreads, and lower bond yields undercut the Fed’s fight against inflation. Ultimately, rallies are still self-defeating and give the Fed more room to hike. (Chart 1)

Chart 1

Therefore, we believe that Fed tightening will remain in force. This not only means more interest rate hikes, but also an acceleration in the Fed’s program of quantitative tightening (QT), this month. Basically, one month does not yet make a trend and inflation expectations are still too high to warrant a proper pivot from the Fed. Therefore, while relief might be in sight, peak relief is still pending.

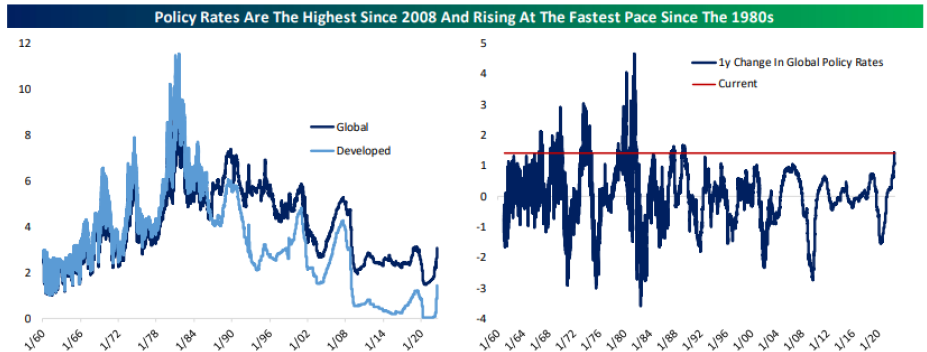

Currently, global monetary tightening remains extreme. Global policy rates are the highest since 2008. The level of rates is not at an extreme yet, but the rate of change is. Over the past year, policy rates have risen at the fastest pace since 1989. (Chart 2) Policy rates are high and rising, with a high likelihood of further acceleration in both the pace and level of rates to come. Eventually, this sort of policy action will have unintended consequences. That’s especially true in a world with high debt loads.

Chart 2

For markets then, accelerated QT coming on top of further interest rate increases will amplify the liquidity squeeze already under way. Ultimately, markets are still at an inflection point. Despite all the negative, we still do not believe we will experience a deep recession in the next 12 months. That means, largely all of the economic damage that we’ve highlighted has been priced into markets. However, there will continue to be volatility while the Fed and the market play chicken. We expect both equities and bond yields to remain range bound until there is more progress made on inflation. Risks remain elevated and we are aggressively monitoring the chances of a deeper economic turmoil.

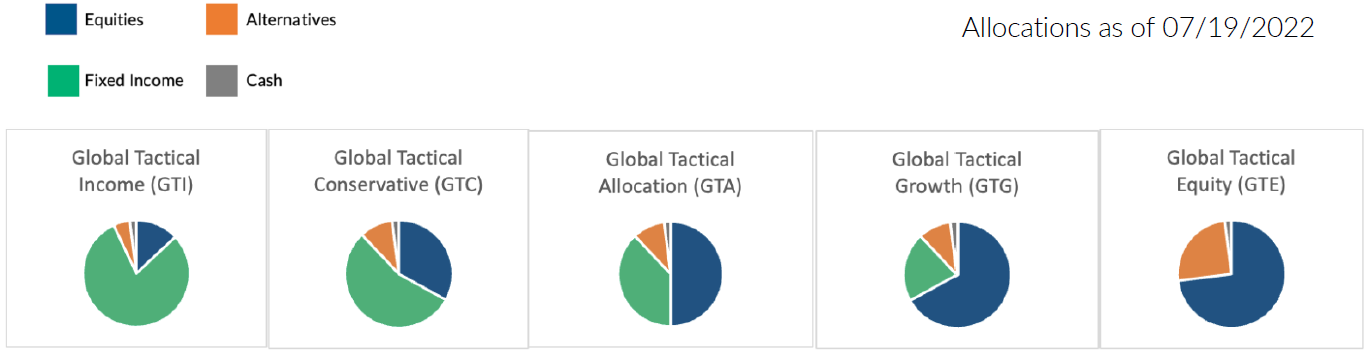

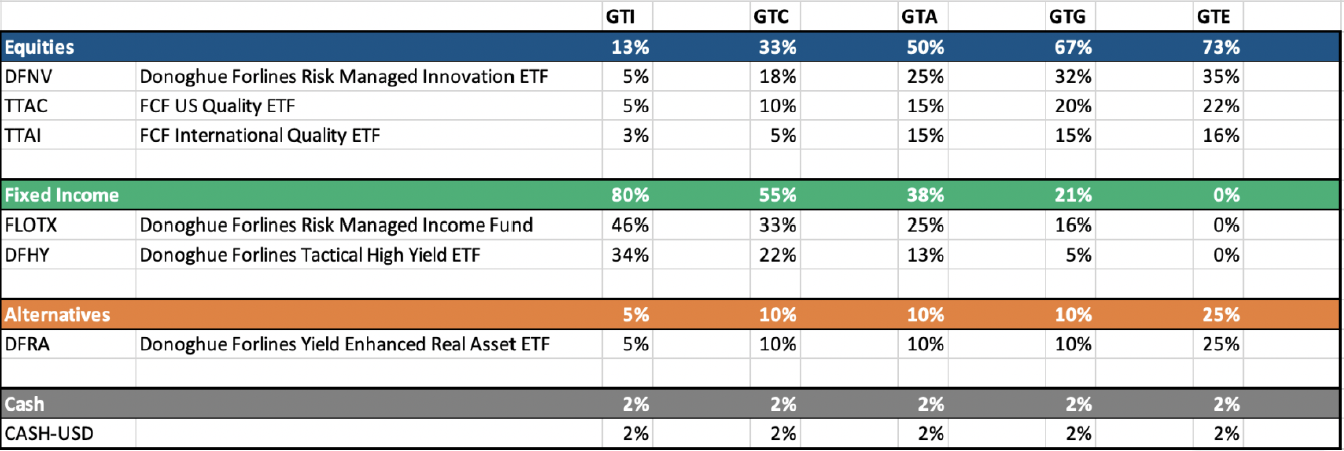

Recent Portfolio Changes

There have been no changes to the portfolio positioning since July 19, 2022.

Changes to Holdings

You can also get more information by calling (800) 642-4276 or by emailing AdvisorRelations@donoghueforlines.com.

John A. Forlines III

Chief Investment Officer

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. The investment descriptions and other information contained in this Markets in Motion are based on data calculated by Donoghue Forlines LLC and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities.

The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate.

The Donoghue Forlines Global Tactical Allocation Portfolio composite was created July 1, 2009. The Donoghue Forlines Global Tactical Income Portfolio composite was created August 1, 2014. The Donoghue Forlines Global Tactical Growth Portfolio composite was created April 1, 2016. The Donoghue Forlines Global Tactical Conservative Portfolio composite was created January 1, 2018.

The Donoghue Forlines Global Tactical Equity Portfolio composite was created January 1, 2018. Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Individual portfolio returns are calculated monthly in U.S. dollars. These returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results. Performance reflects the re-investment of dividends and other earnings.

Regarding GTA, net returns are presented net of actual management fees and include the reinvestment of all income. Actual investment advisory fees incurred by clients may vary.

Beginning January 1, 2022, the 1% model fee was no longer assessed within the performance calculation as Donoghue Forlines no longer charges a model management fee on the portfolio listed below. The portfolio includes holdings on which Donoghue Forlines may receive management fees as the adviser and/or subadvisor or from separate revenue sharing agreements. Please see the prospectuses for additional disclosure.

Regarding GTI, GTC, GTG, and GTE, the investment management fee schedule for the composites is: Client Assets = All Assets; Annual Fee % = 0.00%. Actual investment advisory fees incurred may vary and should be confirmed with your financial advisor.

The Donoghue Forlines Global Tactical Allocation Benchmark is the HFRU Hedge Fund Composite. The Blended Benchmark Conservative is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% Bloomberg Barclays Global Aggregate, rebalanced monthly. The Blended Benchmark Growth is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% MSCI ACWI, rebalanced monthly. The Blended Benchmark Income is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% Bloomberg Barclays Global Aggregate, rebalanced monthly. The Blended Benchmark Equity is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% MSCI ACWI.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage. The underlying constituents are equally weighted. The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Index performance results are unmanaged, do not reflect the deduction of transaction and custodial charges or a management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. You cannot invest directly in an Index. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. For a compliant presentation and/or the firm’s list of composite descriptions, please contact 800‐642‐4276 or info@donoghueforlines.com.

Donoghue Forlines LLC is a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training.